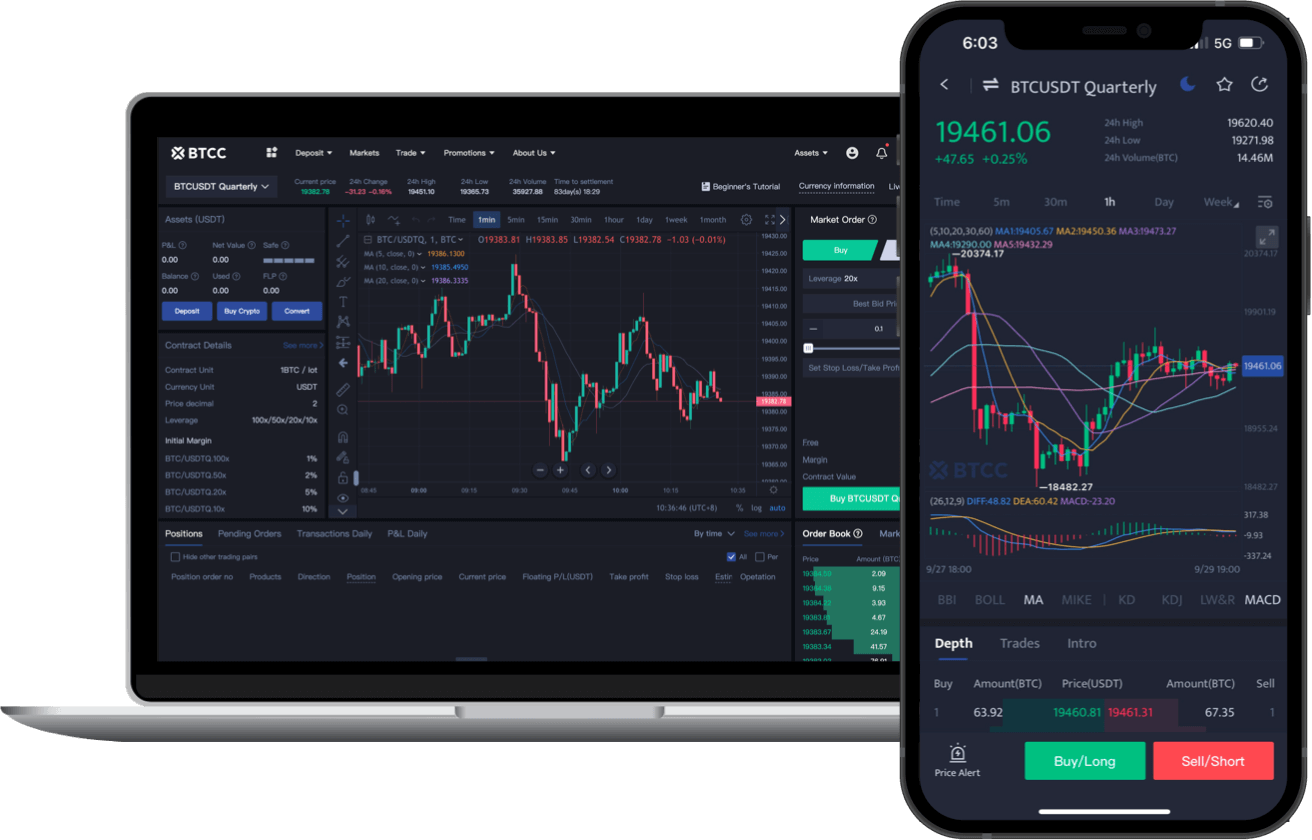

A look into crypto trading

What is cryptocurrency trading?

Cryptocurrency trading refers to the buying and selling of digital currencies on a decentralised digital exchange that uses blockchain technology. Cryptocurrencies are typically digital or virtual tokens that mainly use cryptography. This is to help secure any transactions being made and control the creation of new units of cryptocurrencies.

Unlike traditional currencies, cryptocurrencies are not backed by any financial institution or government. This means that their value is solely determined by supply and demand on the market. This also renders them theoretically immune to government manipulation or interference.

The advantages of crypto trading

Trading cryptocurrencies comes with its own sets of advantages, so it is essential to understand these instruments before trading with them on the financial markets.

Potential for high returns: Cryptocurrencies are known for being extremely volatile. This means they can experience substantial price fluctuations and movements within a short period of time. Experienced and savvy traders may be able to capitalise on these particular movements, presenting them with an excellent opportunity for significant gains.

Lower transaction fees: Compared to traditional financial markets, platforms that allow traders to trade cryptocurrencies tend to have lower transaction fees. These lower costs may mean that traders can save funds in the long run.

Flexibility and Decentralisation: Unlike more traditional financial markets, cryptocurrencies operate in an unregulated and decentralised environment. This means traders have more freedom and flexibility regarding their investment strategies and choices.

Secure and swift transactions: The blockchain technology that makes up cryptocurrencies allows transactions to be more secure and faster. This ensures efficiency in the market, as well as reduces the risk of manipulation or fraud happening.

Best practices for crypto trading

To do well in crypto trading, traders need to follow certain best practices and strategies. Here are a few of them listed below:

Diversify portfolio: This is one of the easiest and best ways to reduce risk when trading. Traders should therefore spread their investments across different types of cryptocurrencies to reduce the impact of potential losses that may happen in a volatile market. In essence, traders should avoid putting all their eggs in one basket. If one cryptocurrency is suddenly not doing well, having a diversified portfolio means traders are more likely to be able to ride out the downturn in the market.

Stay informed about market trends: Traders should make sure to keep track of market trends, events, and news that could influence the value of the cryptocurrencies they are investing in. As such, traders need to stay informed about any significant partnerships and regulatory developments that may impact the market.

Use risk management tools: Traders can minimise their risk by using risk management tools such as stop-loss and take-profit orders. These tools are there to help traders protect their trades in case price movements move in an unfavourable direction.

In–depth research: Traders should conduct comprehensive research before they participate in any form of crypto trading. This means taking a look at and understanding the underlying technology, market capitalisation, use cases, trading volume, and the historical performance of these digital assets.

Types of popular cryptocurrencies

Currently, there are thousands of cryptocurrencies available in the financial market. That said, some have gained more popularity than others. Here are a few examples of popular cryptocurrencies we have broken listed below.

Bitcoin: Bitcoin was the first and remains the most popular and well-known cryptocurrency in the market. It was created in 2009 and has since grown to become the largest cryptocurrency in the world by market capitalisation. Bitcoin remains decentralised and transactions are typically verified using the blockchain a public ledger.

Ethereum: Ethereum remains the second-largest cryptocurrency by market capitalisation, right after Bitcoin. Its decentralised platform allows developers to deploy and build decentralised applications using smart contracts.

Dogecoin: This coin was created as a joke in 2011. However, it has since gained a significant following in recent years. It is a decentralised cryptocurrency that uses the same technology as Bitcoin. That said, it has a faster block time and a higher supply.

Crypto vs forex trading – the difference

Surprisingly, the crypto and forex markets are similar to one another, such as being driven by demand and supply. That said, there are still quite a few differences between them. Here are a few of their differences listed below.

Size

The forex market is big and is the largest financial market in the world. This is because it is made up of transactions from international entities such as banks, investors, companies, individuals, and funds. All of these entities depend on the forex market to exchange and convert currencies in real-time. Although cryptocurrency is still in its beginnings, it has currently made huge strides as the blockchain network has expanded.

Structure

Both forex and cryptocurrency markets are structured to be mainly dependent on supply and demand. This affects how traders can negotiate the price of assets without the approval of government agencies. In fact, trading currencies and crypto can be done over the counter (OTC) or through a brokerage or an exchange. Before trading, it is essential that traders do their research to find the best forex crypto broker to suit their needs.

The market structure for both instruments is also decentralised. This means that the instruments are not issued by any centralised authority such as the government. As a result, there is no single party that controls the market. Some consider this transparency as a strength of the market, especially in the case of trading cryptocurrencies.

Compared to traditional currencies traded on the forex market, cryptocurrencies typically exist only in digital spaces, and they are stored on the Blockchain. As such, cryptocurrency transactions only occur via digital wallets, and they are verified once they have been mined.

Market participants

When comparing the two, there are more market participants in the forex market, as the market is more developed when compared to cryptocurrencies. Those who participate in the forex market include investment funds, central and commercial banks, companies, as well as retail brokers and traders, to name a few.

On the other hand, in the cryptocurrency market, there are roughly three main types of participants. These are miners, exchanges, and traders. Exchanges are specifically digital marketplaces where people can purchase and sell cryptocurrencies. Crypto miners are individuals or companies that complete blocks that are used to verify transactions in the blockchain’s network. Crypto traders are those who speculate on the rise and fall of price movements but do not take ownership of the underlying assets.

Asset accessibility

When compared between the two, the forex market provides more accessibility when compared to the crypto market. This is because there are plenty of currency pairs available, including major pairs such as AUD/USD, minor pairs such as CAD/JPY, and even exotic currency pairs such as CHF/HUF, to name a few. On the other hand, cryptocurrencies have less liquidity. Traders also need a digital wallet and an exchange account to start trading.